What you need is a bank node, not a bank note

Self-custody means being your own bank and having total control of your assets. Having the freedom to send and receive funds without involving third parties. It also means you don't have to worry about your assets being seized or frozen.

Banknotes used to be backed by gold

For many centuries gold functioned as a medium of exchange, which means it has been used for transactions. For trading in small amounts, people were using gold coins. Serious logistics begin when it comes to paying bigger amounts with gold bars. Gold has limited portability – it’s not easy to move geographically. Gold has limited divisibility because it cannot be easily devised into smaller pieces, for smaller transactions. History shows, that gold also can be easily seized. For all these reasons, banks have been hugely profitable over the past decades with their offer to store and protect our Money, so that we don’t have to. Early banks issued bank notes to confirm the amount of gold deposited. The initial agreement said that at any time banks will redeem the notes for gold. This agreement required trust, and this trust has been violated. Banks came off the gold standard and there has been no other asset into which holders have the right to convert their bank notes.

From the gold standard to the fiat system

In 1971 president Nixon terminated the convertibility of the US dollar to gold. In the United States, private ownership of gold was effectively banned between 1933 and 1974 as the U.S. government successfully attempted to move the country away from the gold standard and onto the fiat system.

The term "fiat" is derived from the Latin fieri, meaning an arbitrary act or decree. The value of fiat currencies is ultimately based on the fact that they are defined as legal tender by way of government decree.

Digital money for the Web

With all its precious qualities, gold is not useful on the Internet. For online purchases, we need some form of electronic money. Best, if it comes with the qualities of gold. You may wonder why Bitcoin is often described as digital gold. This is for the fact that Bitcoin not only preserves, but even improves, the monetary properties of gold. Bitcoin is more portable, divisible, and confiscation-resistant than gold.

Private and public keys ownership

The ability to access your money and other financial assets will always be at risk of being restricted as long as someone else has custody over them. One of crypto's greatest strengths is that they don't require any financial institution.

With greater power, comes greater responsibility. Your responsibility in relation to cryptocurrency is to protect private cryptographic keys from being compromised. Private keys are the central element of crypto ownership. You generate a private key – along with a corresponding public key – any time you create a blockchain address. Having the private key for a given blockchain address means that you control everything at that address.

You can treat your public key as your email address, and you can share it with anyone, so people can send you assets. The private key you need to treat like a password that lets you open the address, access what’s inside, and send assets from it.

Digital wallet secures your keys

Your private key gives control over digital assets stored on the blockchain. It’s important to store your key responsibly and protect it from unauthorized access. Digital Wallet gives you the ability to use your keys without them ever being exposed. The purpose of a digital wallet is not actually to store your crypto, but to secure your private keys. Your coins and tokens live on the blockchain.

Among digital wallets, we distinguish between hot and cold wallets. Hot wallets are constantly connected to the Internet. It could be an app on your laptop, or on your phone. In contrast, a cold wallet stays offline most of the time. A cold hardware wallet – like Ledger – is the most secure option. An obvious downside of this approach is that you use another physical device. Although it’s small like a pen drive, you still need to take special care of your hardware wallet. If you lose it or someone confiscates it, you will be still able to recover your wallet with a seed phrase, but it creates an additional hurdle.

The importance of the seed phrase

Private keys in raw format are 256 digits long, which makes them impractical for transactions. When you set up a mobile wallet, a list of 12 or 24 words is shown on the screen. These words are known as a "seed phrase". This is your wallet's backup. The recovery phrase is a derivative of your entire wallet, and all private keys stored there. Having the seed phrase means that even if you lose your device, you’ll still have access to your blockchain assets. To recover your funds, you can download a wallet on another device and input these words. You can use any digital wallet compatible with the BIP-39 Standard Word List.

Your private key and recovery phrase are two halves of the same whole – your recovery phrase is simply your private key in a different format.

To safely store your recovery phrase:

keep it offline,

keep it fire and water-proof,

keep it hidden.

The recovery phrase needs to be physically written down, unlike the private key which is always concealed inside your wallet. The challenge of keeping it out of prying eyes is up to your creativity.

Not your keys, not your coins

You shouldn't leave your cryptocurrency on an exchange. Funds left on an exchange can be lent out without your knowledge. Keeping funds on an exchange also leaves you vulnerable to exchange hacks. Using a non-custodial hot wallet, like an online exchange wallet, you treat the exchange as a trusted third party, which is not much different from using an ordinary bank. You trade security for convenience by keeping your keys in online wallets. One of the basic principles of Bitcoin is “don’t trust, verify”, so putting trust in a crypto exchange is a clear violation of that rule.

Decentralized bank node

Node gives you the ability to operate directly on the Bitcoin blockchain. Running a node also improves network security by validating transactions on the network. Running a Bitcoin node is not the same as mining, and requires way less computing power than mining. If you want to be independent and improve network security, it's definitely a good idea to run your own node.

For instant transactions, you can use Lightning Network, and it doesn’t necessarily have to be small operations, as there have already been single transfers of around $200 million over the Lightning Network, with penny transaction fees.

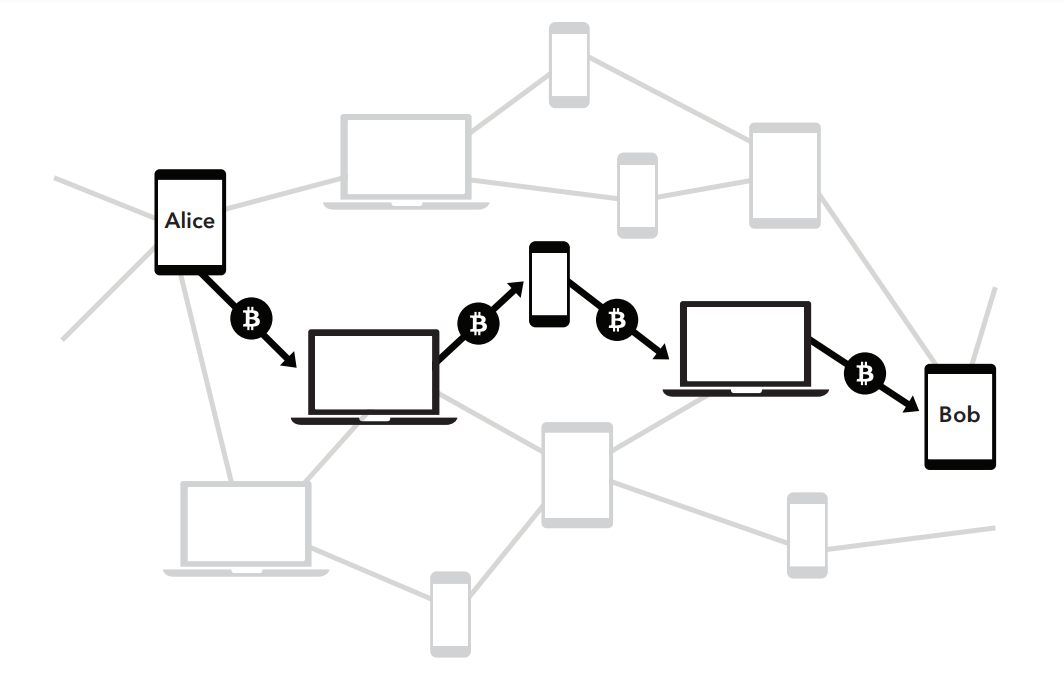

You can, but don’t have to run a Bitcoin or Lightning Network node yourself. Instead, you can download a wallet application that uses one of the existing network nodes. The digital wallet gives you the ability to send and receive bitcoin, without relying on permission from financial institutions.

Summary

We live in interesting times. Historically, uncertain times were hedged with gold. Today, we have better digital assets, like bitcoin, but we can only reap the benefits if we self-custody them.

Inspired by a Twitter post from @Marketsbylili

Thanks for reading!

To support the Bitcoin Masterclass newsletter you can stack some sats in my Bitcoin wallet:

bc1qz0fer0tqaempqehgscn4c6qw9u5skd4a6pxffezqlgv28naanhzqdzmm9a